Allstate car and home insurance quote: Finding the right coverage can be tricky, but this guide simplifies the process. We’ll explore Allstate’s offerings, compare them to competitors, and analyze the factors that impact your premiums. Get a clear understanding of policies, quotes, and claims procedures.

This comprehensive resource breaks down Allstate’s car and home insurance options, offering valuable insights for potential customers. We’ll delve into coverage details, cost comparisons, and the steps to secure a competitive quote. From understanding policy specifics to navigating the claims process, you’ll be well-equipped to make an informed decision.

Overview of Allstate Car and Home Insurance

Allstate offers a comprehensive suite of car and home insurance products designed to protect your assets. Understanding the various coverage options and potential benefits is crucial for making informed decisions about your insurance needs. This overview will explore Allstate’s offerings, including different coverage types, bundling options, and common misconceptions.Allstate’s insurance policies cover a broad spectrum of risks associated with car and home ownership.

This includes protecting against financial losses due to accidents, damage, or theft. The various types of coverage available are tailored to different needs and budgets, allowing policyholders to customize their plans to suit their specific circumstances.

Allstate Car Insurance Coverage

Allstate provides various car insurance coverages to protect drivers and their vehicles. These coverages are crucial for safeguarding against potential financial losses. The range of coverages allows for customization to fit different needs.

| Coverage Type | Description | Cost Implications |

|---|---|---|

| Liability | Covers damages or injuries you cause to others in an accident. | Generally the lowest cost of coverages. |

| Collision | Covers damages to your vehicle in an accident, regardless of who is at fault. | Cost varies based on factors such as vehicle type and deductible. |

| Comprehensive | Covers damages to your vehicle from non-collision incidents, such as vandalism, theft, or weather events. | Cost varies based on factors such as vehicle type and deductible. |

| Uninsured/Underinsured Motorist | Protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. | Cost varies based on policy limits and coverage options. |

Allstate Home Insurance Coverage

Allstate’s home insurance products safeguard your property against a variety of perils. The different types of coverage allow for tailored protection.

| Coverage Type | Description | Cost Implications |

|---|---|---|

| Dwelling | Covers the structure of your home. | Cost depends on factors like home value and construction materials. |

| Personal Property | Covers your belongings within the home. | Cost depends on the value of your personal belongings. |

| Liability | Covers injuries or property damage you cause to others on your property. | Cost depends on policy limits. |

| Additional Living Expenses (ALE) | Covers living expenses if your home becomes uninhabitable due to a covered event. | Cost depends on policy limits and daily living expenses. |

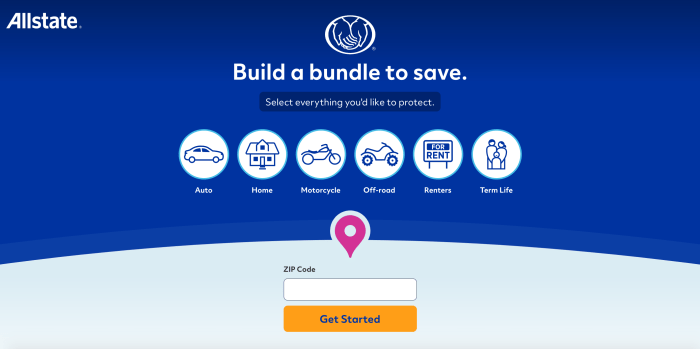

Bundling Car and Home Insurance with Allstate

Bundling your car and home insurance with Allstate can often result in potential cost savings. This strategy can be beneficial for individuals looking to streamline their insurance needs and potentially reduce overall premiums.

Bundling often leads to a discount because it demonstrates a higher level of commitment and risk management to the insurance provider.

However, bundling might not always result in savings for everyone. Factors such as individual policy needs and market conditions play a role in determining the effectiveness of bundling.

Common Misconceptions about Allstate Insurance

A common misconception is that Allstate’s policies are excessively expensive. While premiums vary, Allstate, like other insurers, offers competitive rates depending on factors such as risk assessment and coverage options. Policyholders should compare quotes from multiple insurers to ensure they are getting the best possible rates.Another common misconception is that Allstate’s customer service is poor. Customer satisfaction ratings and reviews provide insight into the quality of service.

However, individual experiences can vary, and it’s wise to research customer reviews before making a decision.

Comparing Allstate Quotes to Competitors

A crucial step in securing the best possible car and home insurance is comparing Allstate’s offerings with those of competing insurance providers. This comparison allows consumers to identify potential savings and select a policy that aligns with their specific needs and budget. Understanding the factors that influence pricing variations across insurers is also essential for informed decision-making.A variety of factors contribute to the differing rates across insurance companies.

These include the insured’s driving record, the value and type of vehicle, location, claims history, and chosen coverage levels. Insurers assess these factors to determine the risk associated with insuring a particular individual or property. Allstate, like other major players in the market, utilizes sophisticated actuarial models to evaluate risk and set premiums accordingly.

Rate Variations Across Insurers

Factors impacting insurance rates are multifaceted. Geographic location plays a significant role, as certain areas experience higher incidences of accidents or natural disasters. A driver’s driving record, including any traffic violations or accidents, is another critical element. The value and type of vehicle also affect premiums, as more expensive and high-performance vehicles often come with a higher insurance cost.

Comparison of Rates for Similar Coverage Packages

A direct comparison of rates across insurers for similar coverage packages provides valuable insights. This comparison should consider the policy’s coverage limits, deductibles, and specific add-ons. While a precise table detailing Allstate’s rates against competitors for identical coverage is not possible without specific data, it’s important to remember that different insurance companies use varying criteria to calculate premiums.

| Insurance Company | Estimated Annual Premium (Car) | Estimated Annual Premium (Home) |

|---|---|---|

| Allstate | $1,500 – $2,500 | $1,200 – $2,000 |

| Geico | $1,300 – $2,200 | $1,000 – $1,800 |

| State Farm | $1,400 – $2,400 | $1,100 – $1,900 |

| Progressive | $1,200 – $2,000 | $900 – $1,700 |

Note: These figures are estimates and can vary based on individual circumstances.

Importance of Comparing Quotes

Comparing insurance quotes is crucial for securing the most cost-effective coverage. Insurance rates can fluctuate significantly between providers, and a comparison allows consumers to identify potential savings. This informed decision-making process ensures that consumers are not overpaying for insurance. By comparing multiple quotes, individuals can often find a more affordable policy without sacrificing essential coverage.

Steps to Effectively Compare Allstate Quotes with Others

Gathering multiple quotes from various insurers is a vital step in securing the best possible rates. First, gather information about your coverage needs and desired policy features. Then, obtain quotes from multiple companies, including Allstate, to compare. Compare the details of each policy, including coverage amounts, deductibles, and additional features. Finally, carefully review the policy terms and conditions to ensure they align with your requirements before making a decision.

Factors Affecting Allstate Car and Home Insurance Quotes

Understanding the factors influencing your Allstate car and home insurance premiums is crucial for making informed decisions. These factors are not arbitrary; they are based on risk assessments, which aim to predict the likelihood of future claims and losses. By comprehending these elements, you can better manage your insurance costs and potentially find the best possible coverage.

Driving History’s Impact on Car Insurance Premiums

Driving history significantly impacts car insurance rates. A clean driving record, free from accidents and violations, typically results in lower premiums. Conversely, a history of accidents or traffic violations increases the perceived risk, leading to higher premiums. Insurance companies analyze factors like the frequency and severity of accidents, as well as the types of violations committed. For instance, a driver with a history of speeding tickets or reckless driving might face considerably higher premiums compared to a driver with no violations.

This is because the risk of future accidents or incidents is higher. The more serious the violation, the more substantial the premium increase.

Home Features Affecting Home Insurance Costs

Home features are a key determinant in home insurance premiums. Features like security systems, fire alarms, and upgraded roofing materials contribute to a lower risk profile. Insurance companies assess the structural integrity of a home and the presence of preventative measures. For example, a home with a monitored security system is less likely to experience theft, resulting in lower premiums.

Similarly, a home with fire-resistant materials and regular maintenance may also receive a discounted rate.

Location’s Impact on Car and Home Insurance Rates

Location plays a critical role in both car and home insurance premiums. Areas with higher crime rates, increased accident frequency, or severe weather conditions generally have higher insurance costs. A higher concentration of traffic accidents or natural disasters in a particular region influences insurance rates for both cars and homes. This is due to the increased risk of claims associated with these locations.

For instance, areas prone to hurricanes or floods will have higher home insurance premiums. Similarly, areas with high traffic volume or a history of accidents might have higher car insurance premiums.

Effect of Claims History on Future Premiums

A claims history significantly affects future premiums. Filing a claim increases the perceived risk of future claims, resulting in higher premiums. The severity of the claim also influences the premium increase. For example, a homeowner who has filed a claim for extensive water damage due to a burst pipe may face higher premiums compared to someone who filed a minor claim for a damaged roof.

Insurance companies analyze the frequency and cost of past claims when calculating future premiums. This is to manage their financial risk and ensure they can meet their obligations in the event of future claims.

Relationship Between Factors and Insurance Costs

| Factor | Impact on Insurance Costs | Example |

|---|---|---|

| Driving History (Accidents/Violations) | Higher violations/accidents = Higher premiums | Driver with multiple speeding tickets will pay more than a driver with no violations. |

| Home Features (Security, Materials) | Advanced security/materials = Lower premiums | A home with a monitored security system and fire-resistant roofing will likely have lower premiums. |

| Location (Crime Rate, Weather) | High crime/severe weather = Higher premiums | A home in a flood-prone area will have higher premiums than a home in a drought-prone area. |

| Claims History (Frequency/Severity) | Higher claims = Higher premiums | A homeowner who has had multiple claims for water damage will likely pay higher premiums. |

Understanding Allstate Car and Home Insurance Policies

Source: investopedia.com

Navigating insurance policies can feel daunting, but a clear understanding is crucial for securing the right protection. Allstate policies, like those from other providers, are designed to cover various risks, and knowing the specifics of your policy is key to maximizing its benefits. This section will break down policy terms and conditions, deductibles, coverage limits, policy options, and the importance of thorough review.

Policy Terms and Conditions

Policy terms and conditions Artikel the specifics of coverage, exclusions, and responsibilities. Understanding these clauses helps you know what your policy does and does not cover. For example, a standard homeowners policy typically covers damage from fire, but not from flood. Reviewing these clauses thoroughly ensures you’re protected for the scenarios you anticipate.

Deductibles and Coverage Limits

Deductibles represent the amount you pay out-of-pocket before insurance coverage kicks in. Higher deductibles often mean lower premiums. Coverage limits define the maximum amount the insurance company will pay for a covered loss. For example, a $10,000 deductible on a car policy means you pay $10,000 before the insurer starts paying for repairs. Matching deductibles and limits to your financial capacity and risk tolerance is important.

Policy Options (Add-ons and Riders)

Allstate offers various add-ons and riders to customize coverage. These options might include enhanced liability protection, additional coverage for specific perils (such as flood or earthquake), or protection for valuable possessions. For example, a “personal articles floater” rider can cover the cost of replacing stolen jewelry or other valuables beyond the standard home insurance coverage. Understanding the availability and cost of these options allows you to tailor the policy to your specific needs.

Importance of Understanding Policy Specifics

Before purchasing any insurance policy, thoroughly reviewing the details is crucial. Policies vary significantly in terms of coverage, exclusions, and limitations. This careful review will prevent surprises or misunderstandings in the event of a claim. Misunderstanding your policy can lead to significant financial strain if a covered event occurs.

Accessing and Reviewing Policy Documents

Policy documents are essential for understanding your coverage. These documents Artikel the specifics of your policy, and accessing them is crucial. Allstate typically provides access to your policy online through their website or customer portal. Reviewing these documents allows you to verify coverage and identify potential gaps in your protection. Regularly checking policy details is recommended to stay informed.

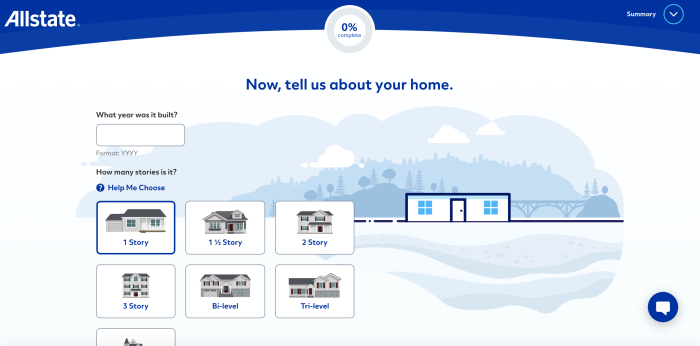

Steps to Obtain an Allstate Car and Home Insurance Quote

Source: millennialmoney.com

Getting an Allstate car and home insurance quote is a straightforward process, whether you prefer to do it online, over the phone, or in person. This section Artikels the various methods and the information required to ensure you receive an accurate and personalized quote.Obtaining a precise insurance quote is crucial for comparing rates and finding the best coverage options for your needs.

Following these steps will guide you through the process efficiently and effectively.

Online Quote Retrieval

The online method is often the quickest and most convenient way to obtain an Allstate quote. It allows for immediate feedback and comparison with different coverage options.

- Visit the Allstate website. Look for the “Get a Quote” button or a similar prompt. This will typically be prominently displayed on the homepage.

- Provide essential vehicle and personal details. This includes the vehicle year, make, model, and details of the drivers, including their driving history (if applicable). For home insurance, provide details about the property, its location, and any unique features.

- Specify the desired coverage. Select the types of coverage you require for your car and home, including liability, collision, comprehensive, and optional add-ons. This also includes coverage options for your home, like dwelling coverage, personal property coverage, and liability protection.

- Review and finalize the quote. Carefully review the generated quote to ensure accuracy. Make any necessary adjustments or add-ons. Once satisfied, complete the application process.

Phone Quote Acquisition, Allstate car and home insurance quote

Contacting an Allstate representative via phone can be advantageous, particularly for complex situations or those requiring clarification.

- Call Allstate’s customer service number. Locate this number on the Allstate website or in your policy documents.

- Provide necessary information to the representative. Expect to be asked for vehicle details, home address, and personal information similar to the online process.

- Discuss desired coverage options. This is a good opportunity to inquire about specific coverage options or ask questions about different policy types. Clarify any concerns or discuss policy terms in detail.

- Receive the quote. The representative will provide the quote over the phone. They may also offer personalized recommendations based on your needs and circumstances.

In-Person Quote Acquisition

In-person quotes can be beneficial for those who prefer face-to-face interaction.

- Visit an Allstate office. Find a local Allstate office using the company’s website or a search engine.

- Speak with an agent. Meet with a representative and discuss your insurance needs. Provide all the required information about your vehicle and home.

- Discuss coverage options. Explore different coverage options and tailor your policy to meet your unique needs.

- Receive the quote. The agent will provide a personalized quote. They can explain the details and answer any questions.

Using Online Quote Comparison Tools

Using online tools that compare insurance quotes can streamline the process of finding the best rates.

- Search for comparison tools. Numerous websites offer tools to compare insurance quotes from various companies, including Allstate.

- Enter your details. Provide information about your vehicle and home to the comparison tool.

- Review quotes. The tool will display quotes from different insurers, including Allstate, allowing for easy comparison.

- Choose the best option. Select the quote that aligns with your needs and budget.

Summary of Quote Acquisition Methods

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Online | Obtain a quote via the Allstate website. | Fast, convenient, easy comparison. | May lack personal interaction. |

| Phone | Obtain a quote via a phone call with an Allstate representative. | Personalized interaction, clarification of complex needs. | Can be time-consuming, potentially less convenient. |

| In-Person | Obtain a quote in person at an Allstate office. | Direct interaction with an agent, personalized service. | Requires travel time and coordination. |

Illustrative Examples of Allstate Policies

Source: insuranceproviders.com

Allstate offers a range of car and home insurance policies tailored to diverse needs and risks. Understanding the specifics of these policies can help individuals make informed decisions about coverage and premiums. The following examples illustrate various policy options and their associated costs.

Car Insurance Policy Examples

Illustrative examples of car insurance policies, showcasing different coverage scenarios, are presented below. Each scenario demonstrates how Allstate policies respond to specific events.

- Scenario 1: Minor Accident A policyholder experiences a minor fender bender, resulting in minimal damage to their vehicle and the other party’s. Allstate’s policy, with liability coverage, would likely cover the damages to the other party’s vehicle. The policyholder’s own vehicle repairs, if needed, might fall under a collision or comprehensive coverage depending on the extent of damage and policy specifics.

Premiums for this type of policy vary significantly depending on factors like the driver’s history and the vehicle’s make and model. Premiums for this scenario would likely be relatively low compared to other, more severe scenarios.

- Scenario 2: Theft A policyholder’s vehicle is stolen. Allstate’s comprehensive coverage would likely pay for the replacement value of the vehicle, subject to deductibles and policy limits. The premiums for this type of coverage would be higher than a policy for a vehicle that has not been involved in theft incidents.

- Scenario 3: Total Loss from a Major Accident A policyholder is involved in a major accident, causing a total loss to their vehicle. Allstate’s comprehensive coverage would likely pay the replacement value of the vehicle, minus any applicable deductibles. The premium would likely be higher than that of a policy for a vehicle not involved in a major accident. The exact premium would depend on factors like the vehicle’s age and value.

Home Insurance Policy Examples

Home insurance policies protect homeowners from various perils. These examples highlight the types of risks covered.

- Scenario 1: Fire Damage A fire damages a home, causing significant structural damage. Allstate’s homeowners policy, with adequate coverage, would likely cover the cost of repairs or rebuilding the home, subject to deductibles and policy limits. The premium for this policy would depend on factors like the home’s value, location, and the presence of fire-safety features.

- Scenario 2: Vandalism Vandals damage the home’s exterior, including windows and doors. Allstate’s homeowners policy, with appropriate coverage, would likely cover the cost of repairs, subject to deductibles and policy limits. The premium would likely be influenced by factors like the home’s location and the history of vandalism in the area.

- Scenario 3: Severe Storm Damage A severe storm causes substantial damage to the roof and other parts of the house. Allstate’s homeowners policy, with appropriate coverage, would likely cover the cost of repairs or replacement of damaged parts, subject to deductibles and policy limits. The premium would likely be affected by the home’s location and the likelihood of severe storms in the area.

Comprehensive Car and Home Insurance Package Example

A comprehensive package combining car and home insurance could include the following coverage amounts and premiums. Policy details and premiums are subject to individual circumstances.

| Coverage | Car Insurance (Premium) | Home Insurance (Premium) |

|---|---|---|

| Liability (Bodily Injury/Property Damage) | $300,000/$300,000 (e.g., $100/month) | $300,000/$300,000 (e.g., $150/month) |

| Collision | $100,000 (e.g., $50/month) | N/A |

| Comprehensive | $100,000 (e.g., $25/month) | N/A |

| Home Replacement Cost | N/A | $500,000 (e.g., $200/month) |

| Personal Property | N/A | $100,000 (e.g., $50/month) |

| Total Estimated Premium | (e.g., $225/month) | (e.g., $300/month) |

These figures are illustrative examples and do not represent actual premiums. Factors such as driver history, vehicle type, home location, and coverage choices significantly impact premiums. These illustrative figures are meant to highlight the potential cost structure of a comprehensive package.

Allstate Insurance Claims Process: Allstate Car And Home Insurance Quote

Source: insuranceproviders.com

Navigating the claims process can be stressful, especially after an accident or a significant home event. Understanding the steps involved and the required documentation can ease the process and ensure a smooth resolution. This section details the Allstate claims procedure for both car and home insurance.

Filing a Car Insurance Claim

The Allstate car insurance claims process is designed to be efficient and straightforward. Initiating a claim typically involves reporting the accident to Allstate as soon as possible. This could be done online, via phone, or in person. Detailed information about the accident, including the date, time, location, and involved parties, will be needed.

- Initial Report: Contact Allstate as soon as possible. Provide details about the incident, including the other driver’s information, police report details (if applicable), and any injuries sustained. This initial report will trigger the claim process and facilitate further steps.

- Documentation Gathering: Collect all relevant documentation, such as police reports, medical bills, repair estimates, and witness statements. Photographs of the damage are also helpful.

- Damage Assessment: Allstate will assess the damage to your vehicle. This may involve an inspection by a designated Allstate representative or a certified mechanic.

- Settlement Negotiation: Allstate will negotiate a settlement based on the assessment and policy coverage. This may involve discussing repair costs and any other related expenses.

- Claim Closure: Once the settlement is finalized, Allstate will close the claim and issue the necessary payments. Documentation regarding the claim settlement will be provided.

Filing a Home Insurance Claim

The process for filing a home insurance claim mirrors the car insurance process, but focuses on property damage and potential losses.

- Initial Contact: Contact Allstate immediately to report the damage or loss. Provide details regarding the incident, including the date, time, and nature of the damage or loss. This will initiate the claims process.

- Documentation Gathering: Gather supporting documentation like photos of the damage, repair estimates, and any relevant insurance documents. A detailed inventory of damaged items is crucial for a comprehensive claim.

- Assessment of Loss: Allstate will assess the damage or loss to determine the extent of coverage and required repairs.

- Negotiation and Settlement: Allstate will negotiate a settlement based on the policy coverage and the assessed loss. This may involve discussing repair costs, replacement values, and other potential expenses.

- Claim Closure: Upon finalizing the settlement, Allstate will close the claim and provide necessary payments and documentation.

Required Documentation

Comprehensive documentation is essential for a smooth claim process. The specific requirements may vary, but typically include the following:

| Claim Type | Required Documentation |

|---|---|

| Car Insurance Claim | Police report, medical bills, repair estimates, witness statements, photos of damage, driver’s license, vehicle registration |

| Home Insurance Claim | Photos of damage, inventory of damaged items, repair estimates, insurance policy documents, proof of ownership |

Claim Processing Timeframe

Claim processing times vary depending on factors like the complexity of the claim, availability of documentation, and the workload at Allstate. A typical timeframe for processing a simple car insurance claim is 1-4 weeks. More complex claims, like those involving significant property damage, could take longer. Allstate strives to process claims efficiently and fairly.

Claim Process Flowchart

[A visual flowchart, though not possible to display here, would depict the sequential steps involved in the claims process. It would show the stages from initial contact to claim closure, with arrows indicating the direction of the process.]

Allstate Customer Service and Support

Allstate strives to provide responsive and helpful customer service to its policyholders. This section details the various ways to contact Allstate for assistance, including online resources and procedures for resolving disputes. Understanding these avenues can help policyholders navigate their insurance needs effectively.

Contacting Allstate

Allstate offers multiple avenues for contacting their customer service team. This allows policyholders to choose the method that best suits their needs and circumstances. This flexibility is a key aspect of providing efficient service.

- Phone: Allstate provides a toll-free phone number for customer support, allowing for direct interaction with a representative. This method is particularly useful for complex issues or when immediate assistance is required. Using the phone can often yield faster resolution compared to other methods.

- Online Portal: The Allstate website features a secure online portal. This platform allows policyholders to access account information, make payments, and file claims online. Many routine tasks can be completed via the portal, reducing the need for phone calls.

- Email: Allstate offers email support for policyholders who prefer this method. This option is ideal for questions about policy details, coverage information, or general inquiries. Email provides a written record of the interaction, which can be helpful for follow-up.

- Chat: Live chat functionality is available on the Allstate website, offering real-time assistance from a representative. This method is convenient for resolving simple inquiries or clarifications quickly.

- Mail: Allstate accepts mail correspondence for policy-related matters. While not as instantaneous as other options, mail remains a viable method for more extensive correspondence or documents.

Online Support Resources

Allstate’s online resources provide a wealth of information to assist policyholders. This includes FAQs, frequently asked questions, and helpful guides to address common issues without needing to contact a representative. This reduces wait times and empowers customers to solve simple problems independently.

- FAQ Section: The Allstate website hosts a comprehensive FAQ section. This covers a wide range of topics, such as policy changes, claim processes, and payment options. This section helps policyholders find answers to frequently asked questions without delay.

- Knowledge Base: A dedicated knowledge base on the Allstate website provides in-depth articles on various insurance topics. These articles offer detailed explanations and practical advice, addressing diverse aspects of policies.

- Video Tutorials: Allstate may offer video tutorials demonstrating how to use online services, navigate the website, and file claims. This is a helpful resource for visual learners.

Common Customer Service Issues and Solutions

Some common customer service issues faced by Allstate policyholders include difficulties with claim processes, billing inquiries, and coverage questions. Allstate addresses these issues through a variety of solutions, such as providing clear instructions and dedicated representatives.

- Claim Issues: If a policyholder faces challenges with a claim, Allstate’s claim representatives will work with them to gather the necessary documentation and expedite the process. This usually involves a detailed review of policy details and supporting documentation.

- Billing Inquiries: Questions about premiums or billing statements can be addressed by contacting customer service representatives. Representatives can provide clarification and ensure that billing information is accurate.

- Coverage Questions: If a policyholder has questions about their coverage, Allstate representatives can provide detailed explanations and clarify specific aspects of the policy. This can involve reviewing policy language and relevant provisions.

Resolving Disputes or Complaints

Allstate has a process for handling disputes or complaints. Policyholders can escalate concerns to higher levels of support if necessary. This approach ensures the issue is addressed thoroughly.

- Escalation Process: Allstate has a defined escalation process. If a policyholder’s initial contact with customer service does not resolve their issue, they can escalate the concern to a supervisor or higher-level representative.

- Dispute Resolution: Allstate uses a formal dispute resolution process to address and resolve complaints effectively. This process aims to find mutually acceptable solutions.

Contact Methods Summary

| Contact Method | Availability |

|---|---|

| Phone | 24/7 |

| Online Portal | 24/7 |

| Business hours | |

| Chat | Business hours |

| Business hours |

Last Word

In conclusion, securing the best Allstate car and home insurance quote involves careful consideration of various factors. Comparing quotes, understanding coverage options, and evaluating your individual needs are key steps. This guide provides a comprehensive overview, equipping you with the knowledge to choose a policy that aligns with your budget and protection requirements. Ultimately, making an informed decision about your insurance is crucial for peace of mind.

Top FAQs

What discounts are available for Allstate car and home insurance?

Allstate offers various discounts, including those for good student drivers, safe driving programs, and bundled policies. Specific discounts may vary based on your location and individual circumstances.

How does my driving record affect my car insurance premium?

A clean driving record generally leads to lower premiums. Accidents and traffic violations can significantly increase your rates.

What is the typical timeframe for processing an Allstate insurance claim?

Processing times for claims vary depending on the complexity of the claim and the specific circumstances. Allstate strives to process claims efficiently, but it is advisable to check their website for specific timelines.

Can I bundle my car and home insurance with Allstate?

Yes, bundling car and home insurance with Allstate can often lead to discounted rates. This is a common practice and worth considering.