Thrivent life insurance quotes are crucial for understanding your financial security. This guide delves into the various aspects of Thrivent policies, from the different types and key features to the online quoting process and comparisons with other providers. We’ll explore the factors influencing quotes, policy options tailored to specific needs, and the best ways to contact Thrivent for assistance.

Understanding the intricacies of Thrivent’s offerings is essential for making informed decisions. This resource will provide clear and concise information, enabling you to navigate the process confidently.

Introduction to Thrivent Life Insurance Quotes

Source: ctfassets.net

Thrivent Financial for Lutherans offers a range of life insurance products designed to meet the diverse needs of its members and clients. This comprehensive overview details the various types of policies available, their key features, and the process for obtaining quotes. Understanding the different options can help you make informed decisions about protecting your loved ones’ future.Thrivent’s life insurance solutions cater to various financial goals and circumstances.

They provide coverage options for individuals and families, addressing potential uncertainties and ensuring financial security.

Types of Thrivent Life Insurance

Thrivent offers several life insurance products, each tailored to specific needs and risk tolerances. These options include term life insurance, which provides coverage for a specific period, and permanent life insurance, offering lifelong protection and often building cash value. The selection of the most suitable policy depends on individual circumstances and long-term financial goals.

Key Features and Benefits of Thrivent Policies

Thrivent policies often include features such as adjustable premiums, which may help manage costs over time. Other benefits might include accelerated death benefits, allowing policyholders to access funds before death under certain conditions. Policy riders, such as accidental death benefits or disability riders, can provide additional coverage and flexibility.

Quote Acquisition Process

The process for obtaining a Thrivent life insurance quote typically involves several steps. First, you will complete an application form detailing your personal information, health status, and desired coverage amount. Next, Thrivent will review your application and conduct a thorough assessment. After the assessment, you will receive a personalized quote outlining the premium costs and coverage options.

In some cases, consultations with financial advisors might be available to guide you through the process and ensure you select the best policy for your situation.

Comparison to Other Major Providers

| Feature | Thrivent | AIG | MetLife |

|---|---|---|---|

| Premiums | Competitive, potentially adjustable | Competitive, often based on risk factors | Competitive, varies based on health and coverage |

| Coverage Options | Term and permanent life insurance | Comprehensive range of life insurance products | Diverse selection, including term and permanent options |

| Customer Service | Generally positive member feedback | Widely recognized for service | High standards of customer support |

| Financial Strength | Strong financial standing, proven track record | Strong financial standing, solid reputation | Strong financial stability, large and established |

This table provides a general comparison. Specific premiums and features can vary based on individual circumstances and policy choices. It’s advisable to compare quotes from multiple providers to make an informed decision.

Factors Influencing Thrivent Life Insurance Quotes

Securing life insurance involves understanding the factors that determine the cost of a policy. Thrivent, like other insurers, uses a variety of criteria to assess risk and establish premiums. Knowing these factors empowers you to make informed decisions about coverage and pricing.

Key Factors Impacting Premium Costs

Several key elements significantly influence the cost of a Thrivent life insurance policy. These factors, evaluated by the insurer, aim to assess the likelihood of a claim and the potential financial burden on the company. A comprehensive understanding of these factors is vital for choosing the right policy and budget.

Age

Age is a primary determinant of life insurance premiums. Younger individuals generally have lower premiums as they are statistically less likely to die in the near term. As individuals age, the risk of death increases, leading to higher premiums. A 30-year-old, for instance, will likely pay less than a 65-year-old for the same coverage amount.

Health

Health status directly impacts life insurance premiums. Insurers assess your health through medical questionnaires and potentially medical exams. Individuals with pre-existing conditions or chronic illnesses often face higher premiums due to the increased risk of claims. For example, a policyholder with a history of heart disease will likely have a higher premium than a policyholder with no such history.

Lifestyle

Lifestyle choices can also affect your life insurance premiums. Activities like smoking, excessive alcohol consumption, or a lack of regular exercise can increase the risk of death and consequently raise premiums. Insurers often consider these factors in their risk assessment. A non-smoker, for example, may pay a lower premium than a smoker.

Coverage Amount

The amount of coverage you choose directly impacts your premium. Higher coverage amounts typically lead to higher premiums as they represent a greater financial risk for the insurer. This is a straightforward relationship; larger coverage amounts mean higher premiums to compensate for the insurer’s increased risk.

Pre-Existing Conditions

Pre-existing conditions, such as diabetes or high blood pressure, are a significant factor in determining life insurance quotes. Insurers carefully consider these conditions during the underwriting process. A policyholder with a pre-existing condition might face a higher premium or potentially be declined for coverage altogether. This is because the insurer assesses the risk associated with these conditions and incorporates them into the premium calculation.

Pricing Models

Thrivent, like other life insurance companies, employs actuarial models to determine premiums. These models consider demographic factors, health information, and other relevant data to calculate the risk associated with each policyholder. The goal is to balance affordability with adequate risk assessment. Comparing Thrivent’s pricing models to those of competitors involves a thorough examination of the methodologies used and the resulting premium structures.

It’s crucial to consider the factors incorporated into each pricing model and how they might affect the final premium.

Relationship Between Factors and Premium Costs

| Factor | Impact on Premium Cost |

|---|---|

| Age | Higher age typically correlates with higher premiums. |

| Health | Pre-existing conditions or poor health usually result in higher premiums. |

| Lifestyle | Unhealthy lifestyle choices, such as smoking, often lead to increased premiums. |

| Coverage Amount | Higher coverage amounts generally correlate with higher premiums. |

| Pre-existing conditions | Presence of pre-existing conditions typically leads to higher premiums or policy denial. |

Obtaining Thrivent Life Insurance Quotes Online

Source: quotesbae.com

Securing a Thrivent life insurance quote online is a convenient and efficient process. This method allows you to explore various policy options and compare coverage amounts at your own pace. It streamlines the initial stages of the insurance application, saving you time and effort.Obtaining a Thrivent life insurance quote online involves a series of steps. These steps typically involve completing an online quote request form, providing relevant personal information, and receiving a preliminary quote.

Steps to Obtain a Thrivent Life Insurance Quote Online

Completing the online quote request form is the first step. This form typically requires specific details to accurately assess your insurance needs and calculate a suitable quote. Thorough completion is essential for a precise and accurate quote.

- Review the form carefully: Before filling out the online form, take time to understand all the fields and their associated requirements. This ensures you provide accurate and complete information. Read the questions carefully and consider the implications of each answer.

- Gather necessary information: Compile all pertinent details, such as your age, health status, desired coverage amount, and other personal data. This pre-preparation step simplifies the online process and ensures a smooth completion.

- Complete the form accurately: Enter all requested information meticulously. Ensure data accuracy, as any errors can lead to an inaccurate quote or rejection of the application. Double-check your entries to avoid potential problems.

- Submit the form: Once you’ve completed all the necessary sections, review your entries again and submit the form. After submitting, you will typically receive an acknowledgment or a confirmation message.

Information Required for the Online Quote Request Form

The online quote request form requires specific information to calculate a tailored quote. Providing accurate and complete information is crucial for receiving an appropriate quote.

- Personal details: This includes your name, address, date of birth, and contact information. This ensures accurate communication and identification.

- Health information: You will likely be asked about your health history, including any pre-existing conditions or illnesses. Transparency in this area is important to ensure accurate assessment.

- Financial information: Details such as your income and assets may be required to understand your financial situation and determine the best policy options. This is a crucial part of the process.

- Coverage preferences: Specify the desired coverage amount, policy term, and other preferences to tailor the quote to your specific needs. Clear articulation of your insurance objectives is important.

Sample Quote Request Form

The following table illustrates a sample quote request form. This provides a general example and may vary based on the specific insurance provider.

| Field | Description |

|---|---|

| Name | Your full name |

| Date of Birth | Your date of birth |

| Address | Your current address |

| Phone Number | Your phone number |

| Email Address | Your email address |

| Desired Coverage Amount | Amount of coverage you desire |

| Policy Term | Length of the policy |

| Health Status | Your health status |

Common Errors When Completing Online Forms

Common mistakes when filling out online quote request forms can lead to inaccurate quotes or delays in the application process. Careful attention to detail is essential.

- Typos and errors in data entry: Errors in personal information can affect the accuracy of the quote or even prevent the processing of the application. Double-checking entered data is important.

- Incomplete information: Failing to provide all required information can result in an inaccurate quote or delay in the process. Completing all fields is critical for a successful quote request.

- Incorrect health information: Misrepresenting your health status can lead to rejection of the application or other negative consequences. Accuracy is paramount.

- Ignoring instructions: Failing to adhere to specific instructions or guidelines can cause issues with the quote request form. Carefully following the instructions is crucial for success.

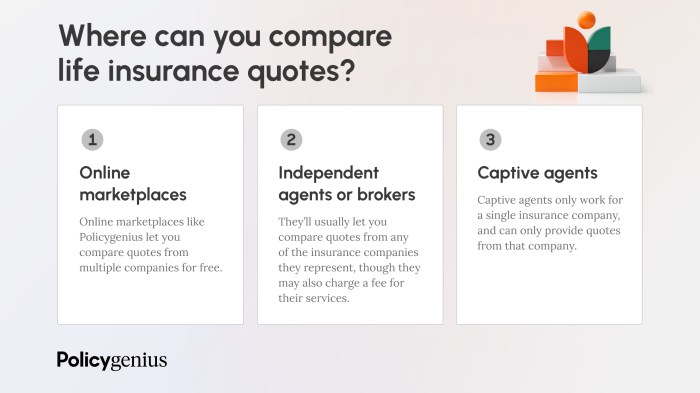

Comparing Thrivent Quotes to Competitors

A crucial aspect of securing the right life insurance policy is understanding how Thrivent’s offerings stack up against those of other major providers. This comparison helps consumers make informed decisions, considering various factors such as premiums, coverage options, and overall value. Evaluating competing quotes provides a comprehensive perspective, allowing for a more nuanced and ultimately beneficial choice.

Key Differences in Pricing

Various factors influence the pricing of life insurance policies across different providers. Policy terms, coverage amounts, insured’s health, and lifestyle choices are key considerations. Premiums are typically higher for higher coverage amounts, those with pre-existing health conditions, or for policies with riders or additional benefits. Additionally, the financial strength and operational costs of each company can also contribute to the price differences.

Comparative Analysis of Quotes

The following table provides a simplified comparison of hypothetical quotes from Thrivent and two major competitors. Note that these are illustrative examples and actual quotes will vary based on individual circumstances.

| Feature | Thrivent (Example) | Competitor A (Example) | Competitor B (Example) |

|---|---|---|---|

| Coverage Amount (USD) | 500,000 | 500,000 | 500,000 |

| Premium (Annual) | $2,500 | $2,700 | $2,300 |

| Policy Term | 20 Years | 20 Years | 20 Years |

| Guaranteed Issue Option | Available (with limitations) | Not Available | Available (with limitations) |

| Additional Riders (e.g., Critical Illness) | Yes, with varying premiums | Yes, with varying premiums | Yes, with varying premiums |

Factors Influencing Price Variations

The differences in pricing between providers stem from several factors. Each company has its own pricing models, based on its cost structure, investment strategies, and the specific risks associated with the insured’s profile. Factors like the insured’s health, age, and lifestyle choices directly affect the risk assessment and consequently, the premium amount.

Options Offered by Competitors

Different providers offer a variety of options beyond the core life insurance policy. Some may include riders for critical illness, accidental death, or disability income. Others may offer varying policy terms or special provisions for specific circumstances. A thorough understanding of these options allows for tailored coverage selection.

Thrivent’s Unique Selling Propositions

Thrivent Life Insurance, while competing in a crowded market, differentiates itself through its unique focus on financial planning and community involvement. Its emphasis on providing comprehensive financial solutions, beyond simply life insurance, sets it apart. Thrivent’s emphasis on community partnerships and ethical business practices are other distinguishing aspects.

Understanding Thrivent Life Insurance Policy Options

Thrivent offers a range of life insurance policies tailored to diverse needs and financial objectives. Understanding these policy types, their coverage, and associated terms is crucial for making an informed decision. This section details the available options, highlighting key features to assist in your selection process.Thrivent policies are designed to provide financial security for loved ones, protecting them in the event of the policyholder’s passing.

By understanding the nuances of each policy type, you can choose the option that best aligns with your individual circumstances and long-term goals.

Policy Types Offered by Thrivent

Thrivent provides several life insurance policy types to cater to various needs and budgets. This section Artikels the common types of policies available.

- Term Life Insurance: Term life insurance provides coverage for a specified period (e.g., 10, 20, or 30 years). Premiums are typically lower than permanent life insurance options, but coverage ceases at the end of the term. This option is suitable for those seeking temporary coverage during significant life stages, such as raising a family or paying off a mortgage.

- Permanent Life Insurance: Permanent life insurance provides lifelong coverage, building cash value that can be accessed during the policy’s lifetime. This option offers a combination of life insurance protection and investment growth. Premiums are generally higher than term life insurance, and the policy remains in effect as long as premiums are paid.

Coverage Amounts and Benefits

The amount of coverage and associated benefits vary significantly depending on the policy type and individual circumstances. Understanding the different options and their potential implications is crucial.

- Term Life Insurance: Coverage amounts for term life insurance are customizable, ranging from a few thousand dollars to several million. Benefits are straightforward: payment of a death benefit to the beneficiaries upon the policyholder’s death.

- Permanent Life Insurance: Permanent life insurance offers various options for coverage amounts. Beyond the death benefit, some policies include cash value components that can be accessed through loans or withdrawals, depending on the policy’s provisions.

Terms and Conditions

Each policy type has specific terms and conditions that govern its operation. These conditions should be carefully reviewed before committing to a policy.

- Term Life Insurance: Term life insurance policies typically Artikel the term length, premium payment frequency, and eligibility requirements. Policy riders may be available to enhance coverage, such as accidental death benefits or disability riders.

- Permanent Life Insurance: Permanent life insurance policies include detailed information about premiums, cash value accumulation rates, policy loan provisions, and potential surrender charges.

Policy Summary Table

| Policy Type | Premium (Example) | Coverage Details |

|---|---|---|

| Term Life (20-Year) | $200/month | $500,000 death benefit |

| Permanent Life (Whole Life) | $400/month | $500,000 death benefit, cash value accumulation |

Considering Needs and Financial Goals

Choosing the right life insurance policy requires careful consideration of your individual needs and financial goals. Factors such as family responsibilities, debt obligations, and future aspirations should be evaluated to determine the most suitable option. For instance, a young professional with a growing family may benefit from a combination of term and permanent life insurance policies. An individual nearing retirement may prioritize permanent life insurance with its built-in cash value accumulation.

Thrivent Life Insurance Quotes for Specific Needs

Source: quotesbae.com

Thrivent Life Insurance offers tailored quotes to address diverse life situations, from young families building futures to retirees securing financial legacies. Understanding these specific needs allows for the development of policies that best support individual circumstances and goals. This section explores how Thrivent adjusts its quotes to meet various needs and highlights the crucial role of coverage amounts and policy terms.

Young Families

Young families often prioritize coverage for dependents and future financial security. Thrivent’s quotes for this demographic typically include options for term life insurance, providing affordable coverage for a set period, or whole life insurance, which offers cash value accumulation. Coverage amounts are often substantial to protect the family’s financial well-being in the event of the primary income earner’s untimely passing.

Policy terms are often flexible, allowing for adjustments as the family grows. This adaptability is a significant advantage, as young families’ needs can change rapidly. Furthermore, the potential for children’s education funds or other long-term goals can be factored into the insurance planning.

Retirees

Retirees often require life insurance coverage for estate planning and ensuring financial stability for their beneficiaries. Thrivent’s quotes for this group may focus on permanent life insurance policies, such as whole life or universal life, that offer lifetime coverage and potentially tax-advantaged cash value growth. Coverage amounts are frequently adjusted to reflect the financial needs of the retiree and their heirs.

Policy terms are typically longer-term to encompass the entirety of retirement and the distribution to heirs. The importance of the policy’s cash value component becomes increasingly significant, potentially supporting retirement income or estate transfer strategies.

Other Life Stages

Individuals in other life stages, such as single professionals or empty nesters, may require varying levels of coverage and policy features. Thrivent’s quotes for these situations will consider factors such as individual financial responsibilities, potential estate needs, and future life goals. The flexibility of Thrivent’s offerings allows for a range of coverage amounts and policy terms to address unique circumstances.

This includes exploring options like term life insurance for a specific period or permanent life insurance for long-term needs.

Comparative Analysis of Quotes

| Life Stage | Coverage Amount Example | Policy Term Example | Key Features | Potential Risks | Potential Advantages |

|---|---|---|---|---|---|

| Young Families | $500,000 – $1,000,000 | 20-30 years | Term life, flexibility, dependent coverage | Premium increases with age, potential for policy lapse | Affordable coverage, future financial protection |

| Retirees | $250,000 – $500,000 | Lifetime | Permanent life, cash value, estate planning | Higher initial premiums, potential for investment risk | Financial security for heirs, potential for cash value growth |

| Single Professionals | $200,000 – $500,000 | 20-30 years or lifetime | Flexibility in coverage, various policy options | Potential for higher premiums depending on risk factors | Financial security, planning for future needs |

The table above presents a simplified comparison of potential Thrivent life insurance quotes for various life stages. It is crucial to remember that these are illustrative examples, and individual circumstances will impact the specifics of each quote.

Implications of Coverage Amounts and Policy Terms

The amount of coverage and the duration of the policy significantly impact the overall cost and benefits. Higher coverage amounts generally result in greater premiums. Longer policy terms often involve higher premiums but offer continuous protection. Understanding the trade-offs between coverage amount, policy term, and premium is essential for making informed decisions. The specific implications for each individual will depend on their unique circumstances and financial goals.

Carefully consider the trade-offs between cost and coverage to ensure a policy aligns with individual needs.

Contacting Thrivent for Quotes

Seeking life insurance involves careful consideration of various factors and options. Understanding the different avenues for contacting Thrivent for a quote is a crucial first step in this process. This section Artikels the methods for obtaining quotes and accessing Thrivent’s expertise.

Methods for Contacting Thrivent

Different methods are available for initiating the quote process. These methods offer various levels of immediacy and personal interaction.

- Phone: Directly contacting Thrivent’s customer service representatives is a common approach. This allows for immediate clarification of specific needs and questions. They can provide preliminary information and answer basic inquiries.

- Email: For less urgent inquiries or those requiring detailed information, email can be a convenient alternative. This approach enables a written record of the conversation and allows for more thorough responses.

- Online Portal: Thrivent’s website often features online quote tools. These tools facilitate self-service quote requests, streamlining the initial steps of the process.

Contact Information

Thrivent maintains multiple points of contact for customer service inquiries. These channels ensure accessibility across various time zones and preferences.

| Contact Method | Details |

|---|---|

| Phone | (Contact number) This number connects to Thrivent’s customer service department for general inquiries and assistance. |

| (Email address) This email address is for inquiries and assistance related to obtaining quotes and information. | |

| Website | (Website address) The Thrivent website provides access to online quote tools, frequently asked questions, and contact forms. |

Scheduling a Consultation

For more in-depth guidance, scheduling a consultation with a Thrivent representative is advisable. This allows for a personalized discussion of individual needs and goals. The consultation can help tailor a suitable policy to specific requirements.

- Appointment Request: To schedule a consultation, contact Thrivent through the preferred method (phone, email, or website). Be prepared to discuss your specific financial goals and insurance needs.

- Representative Contact: A representative will confirm the appointment details, ensuring clear communication and expectations.

The Value of a Qualified Agent

“Seeking advice from a qualified Thrivent agent can provide significant benefits in navigating the complexities of life insurance. They can offer personalized guidance, tailored to individual needs and circumstances.”

Expert guidance is crucial in selecting a suitable life insurance policy. A qualified agent can help identify potential pitfalls and guide you towards the most appropriate coverage.

Finding a Thrivent Agent

Locating a Thrivent agent is a straightforward process. Several methods are available for identifying qualified representatives.

- Thrivent Website: The Thrivent website features a robust agent locator tool. This tool allows users to search for agents based on location, expertise, and other criteria.

- Online Directories: Other online directories might also list Thrivent agents, providing additional avenues for finding a suitable representative.

Illustrative Examples of Thrivent Policies

Thrivent offers a diverse range of life insurance policies tailored to various needs and financial situations. Understanding the different policy types and their features is crucial for making an informed decision. This section provides illustrative examples, highlighting key aspects of these policies and their potential benefits.Thrivent’s policies are designed to provide financial security and support for loved ones in the event of unexpected loss.

Choosing the right policy involves considering factors like coverage amount, premiums, and the specific needs of your family or personal circumstances.

Traditional Whole Life Insurance

Traditional whole life insurance offers a combination of life insurance coverage and a cash value component that grows over time. This growth is often tied to a guaranteed interest rate, providing a certain degree of financial stability.

- Policy Example: A 30-year-old, single professional named Sarah desires a policy that offers both death benefit protection and a savings component. She selects a traditional whole life policy with a $250,000 death benefit and a guaranteed interest rate of 3% annually. This means that, over time, the policy’s cash value will increase, offering a potential source of funds for future needs.

- Financial Implications: Premiums for whole life insurance typically remain constant throughout the policy’s duration, but the cash value grows tax-deferred. This allows for potential tax advantages upon withdrawals or the policy’s eventual maturity. Sarah’s premiums are a fixed amount, making her monthly budget predictable.

Term Life Insurance, Thrivent life insurance quotes

Term life insurance provides coverage for a specific period, known as the term. It typically offers a lower premium compared to whole life insurance, making it an attractive option for individuals seeking coverage for a defined period, such as until their children reach adulthood.

- Policy Example: A 35-year-old, married individual named David wants to ensure his family’s financial security for the next 20 years. He chooses a 20-year term life policy with a $500,000 death benefit. The premiums are relatively low compared to a whole life policy, aligning with his current budget.

- Financial Implications: The premiums for term life insurance are generally lower than whole life, but the coverage is limited to the term. At the end of the term, the coverage ends, and the policyholder must either renew the policy or secure a new policy. David needs to factor in the renewal costs or new policy costs in his financial plan for the future.

Universal Life Insurance

Universal life insurance combines aspects of both term and whole life insurance. It offers a flexible premium structure and the potential for variable growth of the cash value component, based on market performance.

- Policy Example: A 40-year-old business owner, Emily, seeks a life insurance policy with flexibility in premium payments. She chooses a universal life policy with a $300,000 death benefit and an adjustable premium payment plan. This allows her to adjust her premiums based on her income fluctuations.

- Financial Implications: Universal life insurance offers more flexibility than traditional whole life insurance, but the cash value component’s growth is tied to market performance, introducing a degree of investment risk. Emily must carefully monitor market trends and understand investment options to manage her policy effectively.

Illustrative Table of Policy Features

| Policy Type | Death Benefit | Premium Structure | Cash Value Component | Coverage Period |

|---|---|---|---|---|

| Traditional Whole Life | Fixed | Fixed | Guaranteed Interest | Lifetime |

| Term Life | Fixed | Fixed (for the term) | None | Specified Term |

| Universal Life | Fixed | Flexible | Variable Interest | Lifetime |

Long-Term Benefits of Life Insurance

Life insurance provides a safety net for loved ones, ensuring financial security in the event of unexpected loss. It helps cover expenses like mortgage payments, children’s education, and other financial obligations. The long-term benefits can significantly impact families’ ability to maintain their standard of living.

“Life insurance provides crucial financial protection, ensuring your loved ones are cared for after your passing.”

Conclusive Thoughts

Source: quotesbae.com

In conclusion, obtaining Thrivent life insurance quotes involves a multi-faceted approach. This guide has provided a comprehensive overview of the process, from initial inquiries to comparing options. By considering factors like age, health, and coverage needs, you can find a policy that aligns with your financial goals. Remember to thoroughly research and consider professional guidance when making such a significant financial decision.

Common Queries

What are the different types of life insurance offered by Thrivent?

Thrivent offers various life insurance types, including term life, whole life, and universal life, each with distinct coverage durations, premiums, and benefits.

How can I find a Thrivent agent near me?

You can find a Thrivent agent by visiting their website or contacting their customer service.

What are some common mistakes to avoid when completing online quote forms?

Carefully review the form for accuracy, double-check all entered information, and ensure you’ve selected the correct coverage amounts and options.

What is the typical process for obtaining Thrivent life insurance quotes?

The process typically involves providing personal information, answering health questions, and selecting desired coverage amounts. Thrivent then provides a quote based on your profile.