SBLI life insurance quote is your gateway to understanding the crucial aspects of this policy. This comprehensive guide delves into the specifics, providing insights into policy types, cost comparisons, and the quote process. Discover how SBLI fits into your financial strategy, and prepare yourself for informed decision-making.

From the core features and benefits to the intricate details of the claim process, this resource equips you with the knowledge to navigate the world of SBLI insurance with confidence. Explore the nuances of different policies and riders, compare quotes, and gain a clear understanding of the terminology. We’ll cover the entire spectrum, from initial understanding to final execution.

Understanding SBLI Life Insurance

Source: quotacy.com

SBLI, or State Bank Life Insurance, offers a range of life insurance products designed to provide financial security for families and individuals. Understanding the various options and their suitability is crucial for making informed decisions. SBLI policies aim to protect loved ones in the event of an unexpected passing.

SBLI Policy Overview

SBLI life insurance policies provide a death benefit to beneficiaries upon the insured’s passing. This benefit helps cover funeral expenses, outstanding debts, and future financial needs of dependents. Key features commonly include flexible coverage amounts and options for adding riders, such as accidental death benefits or critical illness coverage. Premiums vary depending on factors like age, health, and the chosen coverage amount.

Types of SBLI Policies

SBLI offers different policy types to cater to diverse needs and financial situations. These include term life insurance, which provides coverage for a specific period, and permanent life insurance, offering lifelong coverage. The choice depends on individual circumstances, such as desired coverage duration and financial goals. Variations in coverage amounts and premiums are directly related to the specific type of policy and the chosen coverage period or lifetime protection.

Target Audience

SBLI life insurance is generally suited for individuals and families seeking a readily accessible and relatively affordable way to ensure financial security for their dependents. This can include young families, those with substantial debts, or individuals with dependents who are highly reliant on their income. The ease of purchasing and the competitive pricing make it a popular option for a wide range of demographics.

Comparison with Other Life Insurance Options

| Feature | SBLI | Term Life | Whole Life |

|---|---|---|---|

| Cost | Generally lower premiums, especially for younger individuals, due to simplified processes and limited riders. | Typically lower premiums compared to whole life, as coverage is for a set period. | Higher premiums throughout the policy’s lifetime due to cash value accumulation and investment components. |

| Coverage | Provides a death benefit to beneficiaries, often with options for adding riders for additional coverage. | Provides coverage for a specified period, typically 10, 20, or 30 years. Coverage amount needs to be reviewed periodically. | Offers lifelong coverage with a cash value component that grows over time. Death benefit is typically higher than term life. |

| Flexibility | Offers some flexibility in terms of coverage amount and add-ons. | Provides flexibility in terms of coverage period and options to renew or convert to permanent coverage. | Offers less flexibility in terms of coverage adjustment, and the cash value component often restricts flexibility. |

SBLI Quote Process

Source: financebuzz.com

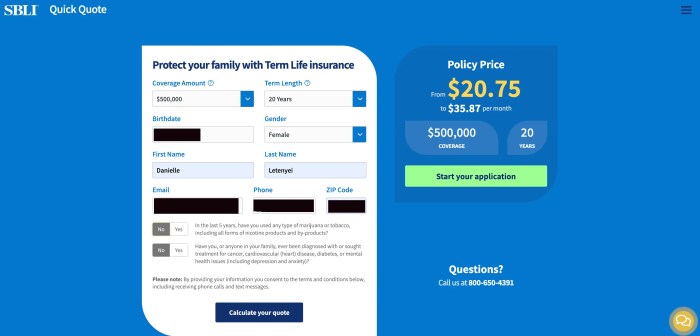

Securing a life insurance quote from SBLI involves a straightforward process designed to provide you with a personalized estimate of premiums. This streamlined approach ensures a smooth and efficient experience, allowing you to make informed decisions regarding your financial protection.

Steps in Obtaining an SBLI Life Insurance Quote

The process of obtaining an SBLI life insurance quote typically involves several key steps. Understanding these steps can help you navigate the process effectively and efficiently.

- Gather Necessary Information: Before initiating the quote process, assemble the required personal details, health information, and desired policy specifics. This comprehensive preparation ensures a smooth and accurate quote generation.

- Access the Online Quote Tool: Many insurance providers, including SBLI, offer convenient online quote tools. These tools provide a user-friendly platform to input your information and receive an instant quote.

- Complete the Online Form: The online form typically requests details about your age, health, occupation, desired coverage amount, and preferred payment options. Careful attention to detail in completing the form is crucial to ensuring accuracy.

- Review and Confirm the Quote: Once you’ve submitted the form, carefully review the generated quote. Ensure all the details, including coverage amount and premium, are correct. If necessary, make adjustments to the parameters.

- Contact SBLI for Clarification (Optional): If any questions or clarifications are needed, contacting SBLI customer support is advisable. This step can help ensure complete understanding of the policy and associated costs.

Online Quote Process

Obtaining an SBLI life insurance quote online typically follows a straightforward procedure.

- Visit the SBLI Website: Navigate to the official SBLI website, often featuring a dedicated section for life insurance quotes.

- Locate the Quote Tool: Identify the online quote tool or form specifically designed for life insurance policies. This often appears prominently on the website.

- Enter Personal Details: Input your age, health status (as indicated by the questions presented), occupation, and desired coverage amount.

- Specify Policy Requirements: Select your preferred premium payment options and any additional policy features.

- Review and Submit: Thoroughly review the generated quote for accuracy before submission. Once satisfied, submit the form for processing.

Factors Influencing Premiums

Several factors influence the premium amount for life insurance policies. Understanding these factors can help you anticipate potential costs.

- Age: Age is a primary determinant of premiums. Generally, younger individuals qualify for lower premiums compared to older individuals.

- Health Status: Health history, including pre-existing conditions, plays a significant role in determining premiums. Insurers assess risk factors to ensure fair pricing.

- Occupation: Certain high-risk occupations may result in higher premiums. Insurers consider the potential hazards associated with various professions when calculating premiums.

- Coverage Amount: The desired coverage amount directly impacts the premium. Higher coverage amounts typically lead to higher premiums.

- Payment Options: Premium payment frequency and method can affect the overall premium amount. Options such as annual, semi-annual, or monthly payments might result in different premiums.

Information Typically Required for a Quote

The following table Artikels the information typically required for obtaining an SBLI life insurance quote.

| Information Type | Example |

|---|---|

| Personal Details | Age, health, occupation, gender, address |

| Policy Requirements | Desired coverage amount, premium payment frequency, preferred policy add-ons |

Comparing SBLI Quotes

Obtaining multiple SBLI quotes is crucial for securing the most suitable life insurance policy. Careful comparison enables you to identify the best value for your needs and financial situation. This process involves a thorough analysis of coverage options, premiums, and policy features.A comprehensive understanding of the factors influencing SBLI quotes allows you to make an informed decision. This involves examining different aspects of the quotes to ensure you choose the most appropriate plan for your circumstances.

Factors to Consider When Comparing Quotes

Different SBLI quotes will vary based on several factors. These factors include the insured’s age, health status, lifestyle, and desired coverage amount. Premiums are also affected by the policy’s duration and riders included. A thorough evaluation of these elements is vital for selecting the most suitable policy.

Aspects to Look for in SBLI Quotes

Analyzing SBLI quotes involves scrutinizing various aspects to determine the best fit. Key elements include the coverage amount, premium costs, policy features, and the reputation and financial stability of the insurance provider. Comparing these aspects will assist in identifying the most appropriate option.

Questions to Ask Insurance Providers Regarding Quotes, Sbli life insurance quote

Understanding the specifics of each quote requires clear communication with the insurance provider. Key questions to ask include those concerning policy features, premium adjustments, and the provider’s financial standing. This process will aid in making an informed decision.

- What are the specific coverage amounts and their associated premiums?

- What are the terms and conditions of the policy, including any exclusions or limitations?

- What are the potential implications of riders, and how do they impact the premium?

- What is the provider’s financial stability and reputation in the insurance industry?

- What is the claim settlement process, and what are the typical timelines?

Sample Quote Comparison Table

The following table illustrates a sample comparison of different SBLI quotes. Note that these are hypothetical examples, and actual quotes will vary based on individual circumstances.

| Quote Provider | Coverage Amount | Monthly Premium | Policy Features |

|---|---|---|---|

| SBLI Company A | ₹10,00,000 | ₹1,500 | Accidental Death Benefit, Waiver of Premium |

| SBLI Company B | ₹12,00,000 | ₹1,800 | Critical Illness Benefit, Accelerated Death Benefit |

| SBLI Company C | ₹15,00,000 | ₹2,000 | Waiver of Premium, Family Income Benefit |

SBLI Policy Features and Options

SBLI life insurance policies offer a range of features and options beyond the basic coverage. Understanding these additions can help you tailor a policy that aligns with your specific needs and financial goals. Careful consideration of these features and options is crucial for making an informed decision about your life insurance.SBLI policies commonly include features like flexible premiums, varying death benefit amounts, and the ability to adjust coverage as your circumstances change.

Beyond the core policy, various add-on options, often referred to as riders, can significantly enhance the coverage provided. These riders can address specific needs, such as critical illness, accidental death, or disability.

Common Features of SBLI Policies

SBLI policies often include options for adjusting premiums and coverage amounts based on your financial capacity and evolving needs. This flexibility can be a valuable asset as your life circumstances change. The policy may also offer the ability to add beneficiaries or change their designated shares in the event of a life change.

Add-on Options Available with SBLI Life Insurance

Various add-on options are available to enhance the base SBLI policy. These add-ons, often called riders, are supplementary benefits that extend beyond the fundamental death benefit. They can be crucial in mitigating potential financial risks associated with specific life events.

Riders and Their Importance

Riders are supplementary insurance benefits that augment the core coverage of an SBLI policy. They address specific risks and can provide additional financial protection for your beneficiaries or yourself. For example, a critical illness rider could provide a payout if you are diagnosed with a critical illness, helping to cover medical expenses. The inclusion of riders can significantly increase the overall value of your life insurance policy.

Policy Riders and Their Implications

| Rider | Description | Cost |

|---|---|---|

| Accidental Death Benefit Rider | Pays a higher death benefit if the death is accidental. | Higher premium |

| Critical Illness Rider | Provides a payout upon diagnosis of a critical illness, helping cover medical expenses. | Higher premium |

| Waiver of Premium Rider | Waives premiums if you become disabled, ensuring the policy remains active. | Higher premium |

| Disability Income Rider | Pays a monthly income if you become disabled and unable to work. | Higher premium |

| Return of Premium Rider | Returns a portion of premiums paid if the policy terminates within a specified timeframe without a claim. | Higher premium |

Understanding SBLI Insurance Terminology: Sbli Life Insurance Quote

Source: financebuzz.com

Navigating the world of life insurance can feel daunting, especially when encountering unfamiliar terms. This section serves as a glossary, clarifying key phrases and terms commonly found in SBLI (State Bank Life Insurance) policy documents. Understanding these terms will empower you to make informed decisions about your coverage.This comprehensive glossary provides definitions for crucial SBLI terms, enabling a clearer comprehension of your policy’s stipulations.

It aims to demystify the jargon and facilitate a better understanding of your life insurance options.

SBLI Policy Term Definitions

This section presents a categorized list of commonly used terms in SBLI life insurance policies, presented for easy reference. Knowing these terms will enhance your comprehension of your policy and related documents.

- Accidental Death Benefit

- A payout in addition to the basic death benefit if the death is a result of an accident. This often requires specific clauses or rider options.

- Beneficiary

- The person or entity designated to receive the death benefit proceeds upon the insured’s passing. This is a crucial component of any life insurance policy, as it dictates who receives the funds.

- Cash Value

- Certain life insurance policies accumulate a cash value over time. This represents the investment portion of the policy. The cash value can be accessed, borrowed against, or used to pay premiums.

- Death Benefit

- The amount payable to the beneficiary upon the insured’s death, as Artikeld in the policy. This is the primary financial protection offered by life insurance.

- Disability Benefit

- Some policies offer additional coverage for a disability preventing the insured from working, often in conjunction with a defined level of disability. This can provide financial support during periods of incapacity.

- Grace Period

- A specified timeframe after a premium payment is due in which the policy remains in effect, preventing lapses. This provides flexibility in managing payments.

- Incontestability Clause

- A clause in a life insurance policy that states the insurer cannot contest the validity of the policy after a specific period, typically two years, from its issuance. This period is crucial for policyholders to avoid disputes after the policy has been in effect.

- Insured

- The individual whose life is covered under the policy. This person is the subject of the life insurance protection.

- Premium

- The periodic payment made by the policyholder to maintain the life insurance coverage. The premium amount is a key factor in the cost of the policy.

- Policy

- The formal legal document outlining the terms and conditions of the life insurance agreement between the policyholder and the insurance company. This document is a legally binding contract.

- Policy Rider

- A supplemental contract added to a base life insurance policy to provide additional benefits or coverages. Riders often cover specific circumstances, such as accidental death or disability.

- Term Insurance

- A type of life insurance that provides coverage for a specific period, such as 10, 20, or 30 years. After the term expires, the coverage ends unless renewed.

- Whole Life Insurance

- A type of permanent life insurance that provides coverage for the entire lifetime of the insured. This policy accumulates cash value and often features a fixed premium.

- Waiver of Premium

- A provision in some life insurance policies that waives the premium payments if the insured becomes disabled. This protects against financial hardship during disability.

Important Considerations

Understanding the specific terminology within your SBLI policy is crucial. Reviewing the complete policy document is essential to ensure a thorough understanding of all terms and conditions. The insurance company’s website or a financial advisor can provide additional clarification if needed.

SBLI Insurance Claims Process

Source: millennialmoney.com

Filing a claim with SBLI life insurance requires a structured approach to ensure a smooth and timely process. Understanding the steps involved and the necessary documentation is crucial for a successful claim resolution. This section details the claim process, outlining the required documents, timelines, and a step-by-step guide.

Claim Filing Procedure Overview

The SBLI claim process is designed to be efficient and transparent. A well-organized claim submission, supported by the necessary documentation, significantly expedites the review and approval process. Claims are assessed based on the specific policy terms and conditions, ensuring fairness and accuracy.

Required Documents for a Claim

The documentation required for an SBLI claim varies depending on the circumstances. Essential documents often include, but are not limited to, the following:

- Original policy document.

- Proof of death (e.g., death certificate). This is typically the most crucial document, serving as definitive proof of the insured’s demise.

- Claim form completed and signed by the claimant.

- Supporting documents to establish the insured’s identity and relationship to the beneficiary (if applicable).

- Relevant medical records (if applicable), if the death is due to a pre-existing condition.

- Any other documents that support the claim.

Timeframe for Claim Processing

The timeframe for processing an SBLI claim can vary depending on the complexity of the case and the completeness of the submitted documentation. While SBLI strives to process claims efficiently, the time required for review and approval can range from a few weeks to several months. Factors influencing the processing time include the accuracy of the information provided and the availability of supporting documents.

Claims with all necessary documents and accurate information are typically processed faster.

Step-by-Step Guide for Filing an SBLI Claim

Following these steps can streamline the SBLI claim process:

- Gather all necessary documents. This is the initial and crucial step. Ensure you have all required documents to avoid delays.

- Complete the claim form. Carefully fill out the claim form, providing accurate and complete information. Errors or omissions in this form can cause delays.

- Submit the claim form and supporting documents. Submit the completed claim form and all required supporting documents to the designated SBLI claim department. Methods of submission can vary, so it’s essential to follow the instructions provided by SBLI.

- Follow up with SBLI. Once the claim has been submitted, it’s essential to follow up with SBLI to inquire about the status. This ensures transparency and prompt communication regarding the claim progress.

- Review and appeal (if necessary). If the claim is denied, review the denial notice carefully and understand the reasons. If needed, you have the right to appeal the decision according to SBLI’s procedures.

SBLI and Financial Planning

Source: insuranceforburial.com

SBLI life insurance can be a valuable component of a comprehensive financial plan, complementing other investments and protecting your loved ones’ financial future. Understanding how it integrates with your existing financial strategies is crucial for making informed decisions. Integrating SBLI with your overall financial health can significantly impact your family’s long-term security.A well-structured financial plan considers your current financial situation, future goals, and potential risks.

SBLI, by providing a death benefit, helps mitigate the financial impact of unforeseen events, such as the loss of a primary income earner. This, in turn, ensures financial stability for your family.

Integrating SBLI with Other Financial Products

A robust financial plan often involves a combination of strategies. SBLI can be effectively integrated with other financial instruments like retirement accounts, investment portfolios, and property. The right combination of tools can help optimize your wealth management and achieve your long-term financial objectives.

- Retirement Accounts: SBLI can work harmoniously with retirement savings. For example, a substantial retirement fund may not entirely account for the potential loss of income in the event of a premature death. SBLI can provide a crucial safety net for the surviving spouse and children, ensuring they can maintain their lifestyle and financial security, even during a difficult transition period.

- Investment Portfolios: A diversified investment portfolio, while crucial for long-term wealth building, may not directly address the immediate need for life insurance coverage. SBLI provides immediate protection, complementing investments that focus on growth and long-term returns. The death benefit of the policy can help the beneficiaries manage the associated costs of estate settlement and future financial needs.

- Property: The death benefit from SBLI can help with the costs of property settlement and inheritance, particularly in scenarios where the property is a primary asset. This could include mortgage repayments, estate taxes, and other associated costs.

SBLI and Different Life Stages

The suitability of SBLI can vary across different life stages. Adjustments to coverage and policy features can be made as needs evolve.

Note: This is a conceptual illustration and should not be interpreted as financial advice. Consult a qualified professional for personalized guidance.

| Life Stage | SBLI Considerations |

|---|---|

| Young Adulthood | Building a foundation for financial security and protecting dependents. Initial coverage may be sufficient for basic needs. |

| Family Formation | Increasing coverage to encompass the financial responsibilities of raising a family. SBLI’s death benefit can significantly ease the burden of supporting children and dependents. |

| Mid-Career | Reviewing and potentially adjusting coverage based on changing financial circumstances and family dynamics. |

| Retirement | Reviewing coverage to align with the needs of retirement. The focus might shift to ensuring the financial well-being of surviving spouse and legacy. |

Importance of Professional Financial Advice

Seeking guidance from a qualified financial advisor is essential when considering SBLI or any significant financial decision. Their expertise in financial planning, investment strategies, and risk management can help you make well-informed choices that align with your individual circumstances.

“A financial advisor can tailor a financial plan that integrates SBLI with other financial instruments, providing a comprehensive approach to financial security.”

A professional financial advisor can assess your unique needs, goals, and risk tolerance to determine the appropriate SBLI coverage and policy options. They can help you understand the implications of various choices and ensure your plan remains relevant as your life circumstances evolve. This personalized approach is critical to maximizing the benefits of SBLI and achieving your financial objectives.

Wrap-Up

In conclusion, obtaining an SBLI life insurance quote is a crucial step in securing your financial future. This guide has provided a thorough overview, covering everything from policy types and quote procedures to comparing options and understanding essential terminology. Remember to thoroughly research and compare quotes before making a decision. Ultimately, the right choice hinges on careful consideration of your individual needs and circumstances.

Commonly Asked Questions

What are the common factors considered by insurers when determining premiums for SBLI?

Insurers typically consider factors like your age, health, occupation, lifestyle, and the desired coverage amount when setting premiums. A detailed health assessment is often necessary.

What are some typical add-on options available with SBLI life insurance?

Common add-on options might include accidental death benefits, critical illness riders, or disability riders. These riders often enhance coverage and provide additional financial protection.

How long does the claim process typically take for SBLI?

The claim process timeframe can vary depending on the specific insurer and the complexity of the claim. It’s essential to understand the claim process timeline beforehand, and to document all necessary information to expedite the process.

What documents are generally required when filing an SBLI claim?

Required documents for filing an SBLI claim usually include the policy document, proof of death (if applicable), supporting medical records, and any other documentation specified by the insurance company.

How can I compare different SBLI quotes effectively?

Compare quotes based on coverage amounts, premiums, policy features, and any associated riders. Carefully review the fine print and understand the terms and conditions of each policy. Seek advice from a financial advisor if needed.